Key Takeaways

- Boosting profitability starts with making smart decisions backed by strong data. By analyzing patterns and trends, business leaders can quickly react to disruptions and improve operations.

- Organizations with high employee engagement outperform those with low engagement by 18% in productivity and 23% in profitability.

- Optimizing your organization's technology can reduce infrastructure costs and improve scalability and efficiency.

Business leaders are prioritizing growth, technology, workforce, and financial performance over the next year. These areas are also of extreme importance to profitability. After all, the more profitable your business is, the more you can invest in opportunities for growth.

Boosting profitability doesn’t have to be complex. It begins with making smart decisions backed by strong data. By looking at patterns and trends, business leaders can quickly react to disruption and improve operations.

Here are four ways to increase profitability in your business:

- Create an agile strategic plan

- Prioritize cost vigilance

- Focus on your talent

- Optimize your technology

Create an Agile Strategic Plan

The ability to shift quickly to a variety of circumstances is only possible through continuous monitoring and adjustment. This starts with understanding your organizational value, including financial metrics, brand, customer satisfaction, employee retention, and more. In short: when you understand where you are, you can move forward faster.

Organizational health is the strongest predictor of value creation and a sustainable source of competitive advantage, accounting for more than 50% of a company's long-term success in the global marketplace.

Quick decision making relies on having trackable KPIs and visibility into your data, especially when it comes to emerging opportunities. Awareness of your current state allows you to calculate future project profitability and accurately assess potential investment and acquisition opportunities.

Leverage Trend Analysis and Scenario Forecasting

Staying ahead of industry trends isn’t just about keeping up — it’s about positioning your organization to lead. 71% of leaders surveyed by HLB are using predictive analytics to track future trends in 2025. By regularly reviewing and comparing trends across industry, you can identify shifts in market conditions and uncover emerging customer needs.

Static spreadsheets will only get you so far. Basing your growth goals on broad assumptions overlooks the nuanced items that drive performance.

Additionally, using your data to analyze “what-if” scenarios — such as economic changes, supply chain disruptions, or changes in consumer behavior — can help you prepare for the unexpected. Instead of reacting, you can develop proactive strategies to mitigate risk and position your organization to thrive in any environment.

Prioritize Cost Vigilance

Success is not only about growth but about building a foundation of financial resilience. Organizations that optimize their cash flow experience higher profitability than their competitors.

Optimize Cash Flow

Optimizing cash flow ensures funds move efficiently into and out of your business, allowing for reinvestment and reducing financial strain.

Strategies for cash flow optimization include:

Analyzing Payables and Receivables

Streamlining the collection of accounts receivable and negotiating better payment terms with suppliers can significantly improve cash flow.

Fixed Cost Analysis

Identifying and reducing semi-fixed costs such as rent, administration, and production can improve liquidity.

Scenario Forecasting

Utilizing software to forecast cash flow for multiple scenarios, businesses can prepare for fluctuations and maintain financial stability.

Fixed operational costs can account for over half of a business’s income, and IDC reports that companies lose 20 to 30% of their annual revenue to inefficient processes. In other words, it’s time to pay attention to your operational costs.

Identifying and improving inefficient business processes is vital to eliminating waste. Look for areas to improve like manual data entry, poor inventory management, redundant approval processes, and outdated technology.

Utilize Tax Credits and Incentives

Leveraging tax credits and incentives allows you to reduce tax liability. And in the case of refundable credits, you may receive a direct cash influx, providing an opportunity for greater investments.

Some widely available tax credits and deductions include:

- Energy incentives

- Research & Development Credit

- Discretionary and statutory incentives

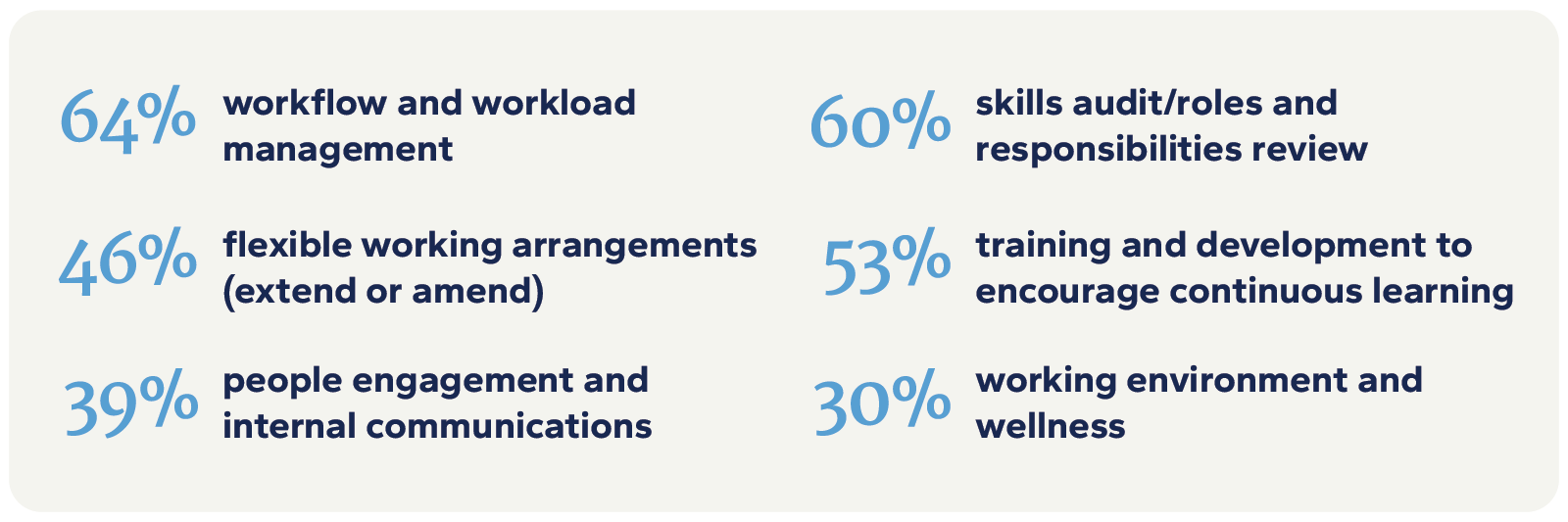

Focus on Your Talent

Between the high cost of employee turnover and the operational disruption that ensues, it’s critical to prioritize your employee experience. Research shows that investing in employee satisfaction results in higher retention rates and improved profitability.

Organizations with high employee engagement outperform those with low engagement by 18% in productivity and 23% in profitability.

Emerging technology adoption has direct ties to employee engagement.

One way to look at employee engagement is by reviewing manual, repetitive tasks. Implementing strategic automation frees your employees to do more value-added activities and strategic work.

Across North America, business leaders are using AI tools in the following ways to help analyze, support, and improve workforce effectiveness and engagement:

Play to Your Strengths

Outsourcing specialized areas where you lack internal resources offers cost savings, access to specialized expertise, and increased operational efficiency. This approach allows internal teams to concentrate on strategic initiatives, while the outsourced functions are handled by professionals who bring industry-specific knowledge and technology.

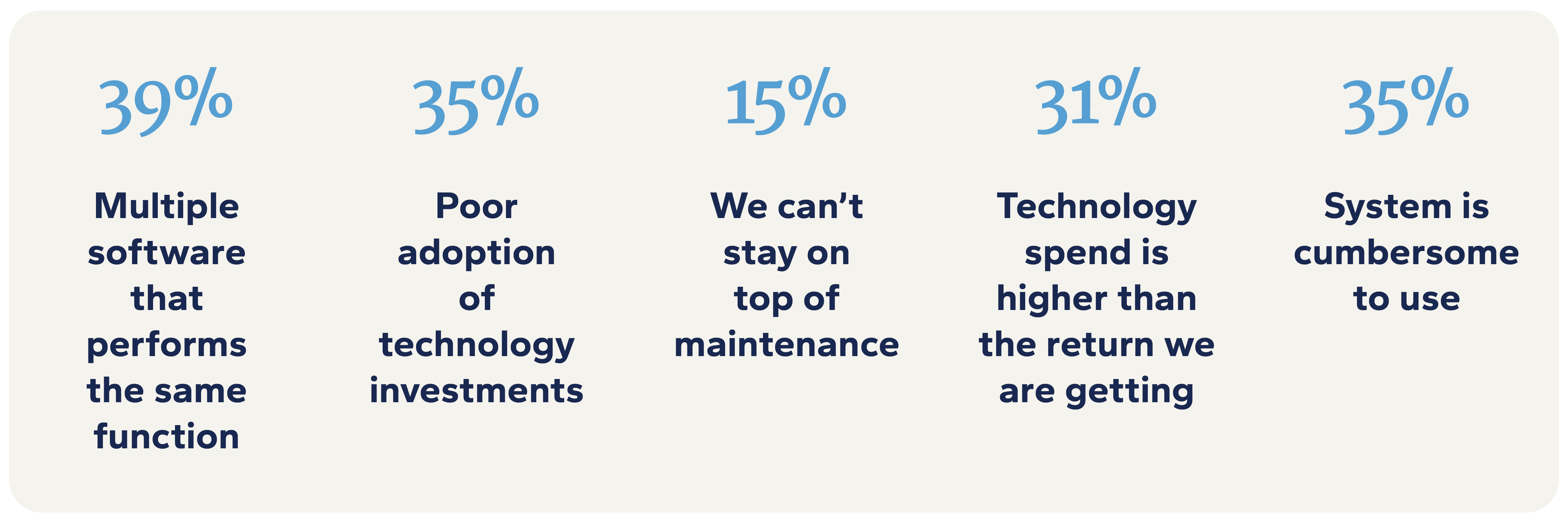

Optimize Your Technology

Technology is a powerful enabler of business efficiency. Optimizing your organization’s technology can reduce infrastructure costs and improve both scalability and efficiency.

When asked about technology waste and inefficiencies, our clients report the following challenges:

Yes, new investments in technology to fill functional gaps is important. However, as we regularly tell our clients, optimizing existing systems and tools leads to more calculated, controlled growth. A business and technology assessment will help you understand where to focus to achieve optimal efficiency.

- Read more about how to make impactful decisions for your organization and budget in Your IT Budget and Your Digital Journey: How to Invest Strategically.

Key areas we encourage clients to review include:

Data Utilization

Organize your data to enable faster, more accurate reporting. Tools like dashboards and analytics software centralize information, empowering decision-makers with real-time data to guide strategy and identify cost-saving opportunities.

Integrations

Leverage tools that integrate seamlessly to reduce manual effort and errors, cutting operational costs.

Automation

Automate repetitive tasks to enhance efficiency and free up resources for high-value activities that drive revenue growth.

AI Readiness

Evaluate your readiness to adopt AI and other advanced technologies to boost both performance and profitability.

Increase Profitability Today

When profitability becomes a priority, growth follows naturally. With the right approach, you’re not just preparing for the future — you’re shaping it.

So what are the next steps you can take?

- Conduct a thorough performance assessment to identify areas where cost savings and cash flow improvements can be made.

- Implement financial modeling and KPIs to guide decision-making and measure progress.

- Optimize technology and employee engagement to drive continuous performance improvements.

- Monitor progress and adjust strategies regularly to stay on track for long-term profitability.

By focusing on these key strategies, you can navigate financial challenges and emerge stronger and ready for the future.

At Eide Bailly, we use our business and technology expertise to help organizations optimize performance and protect what they’ve built, so they can prosper into the future. From aligning financial decisions with strategic goals to optimizing operations and technology, we provide the insights and tools you need to drive sustainable growth and long-term success.

The Importance of Metrics that Matter

.jpg)